The boy whose story spread across continents, cultures, and languages. A story that sold more than 120 million copies worldwide, and inspired the imagination of children and adults across the world. Harry Potter gripped the hearts of millions, and not by magic, but by selling the fight of good versus evil, love versus hate, and bravery versus fear. The story of the boy who lived will live on forever in time. A great story is an asset to behold.

We are not sure if there is a fight for good and evil in the Warner Brothers Discovery story. But there is surely a fight. A fight that will turn into a war over which entertainment platforms will dominate eyeballs for years to come. Let us now embark on the tale of Warner Brothers Discovery’s history and the industry it competes in so we may hope to glean something valuable when we attempt to peer into its future.

A short history of content and distribution

As technology changes, so does the battlefield: historically, consumers gorged their eyeballs on cable TV. Cable companies, like AT&T or Comcast, often own their own cable TV services and bundle up different TV networks to sell to consumers. They either pay the TV networks for programming rights or they own the TV networks. TV networks (Turner, CNN, ABC, Universal Kids) generally have a mixture of their own content, and acquire rights from production companies like HBO, Disney, Fox, to use their content.

The streaming platforms changed the game quite a bit. The industry labels it as DTC (direct-to-consumer). There is no need for a streaming platform to go through a cable TV service provider to offer content to its viewers. Cable TV is dying.

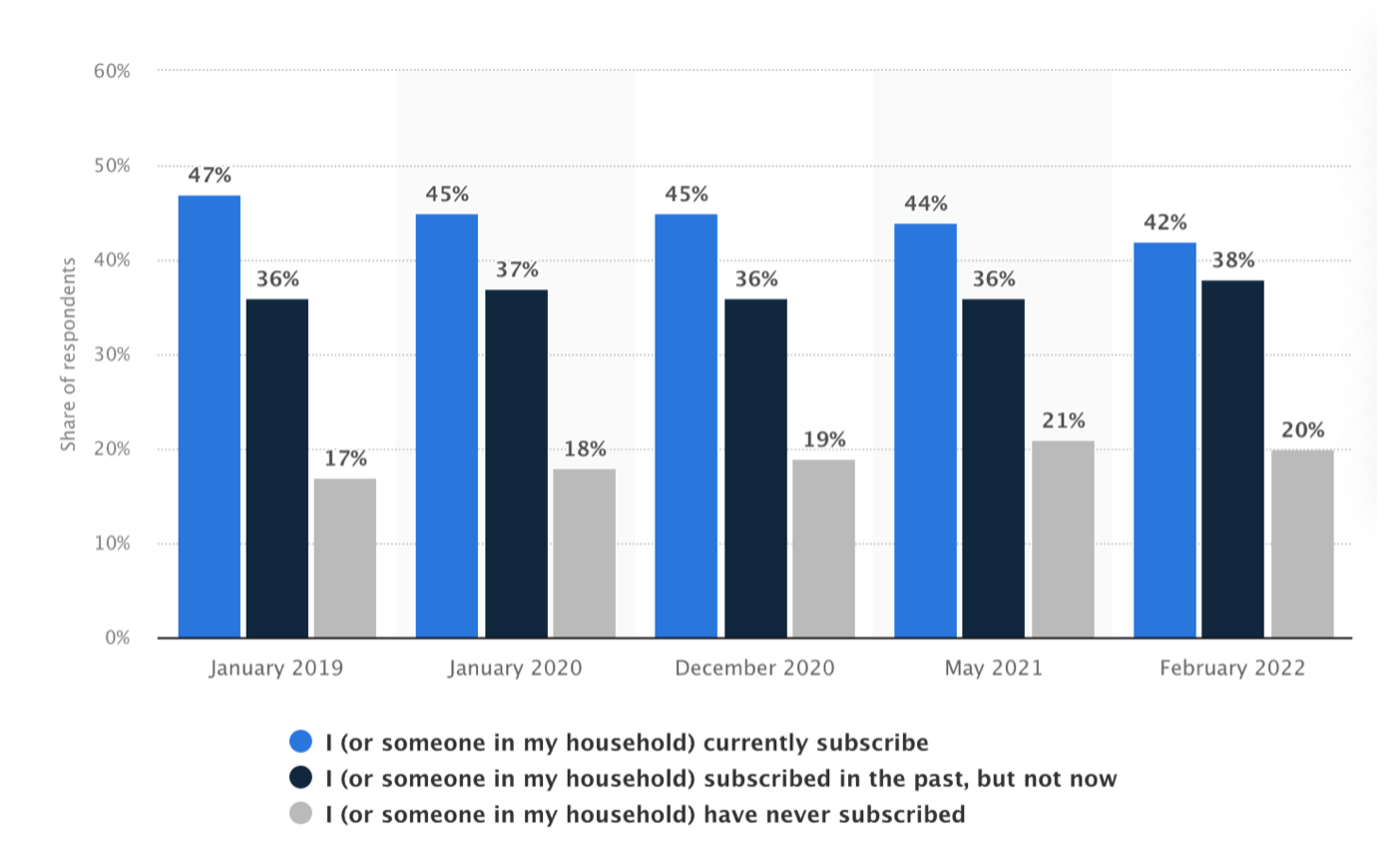

Below is the share of respondents who subscribe to a cable TV service in the United States.

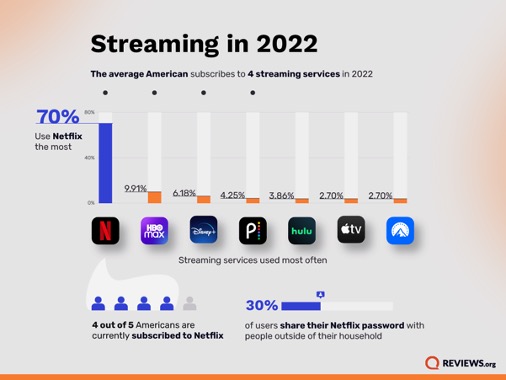

Kids today will probably never understand television. They won’t understand why anyone paid for a product where you had to flicker through channels looking for something to watch. Households in the future will all have a smart TV with 3-4 of the best streaming platforms. Netflix, Disney, HBO Max, and probably Prime Video from Amazon. The others will die out and their content will be acquired by the big 4. Then the big 4 will start raising prices.

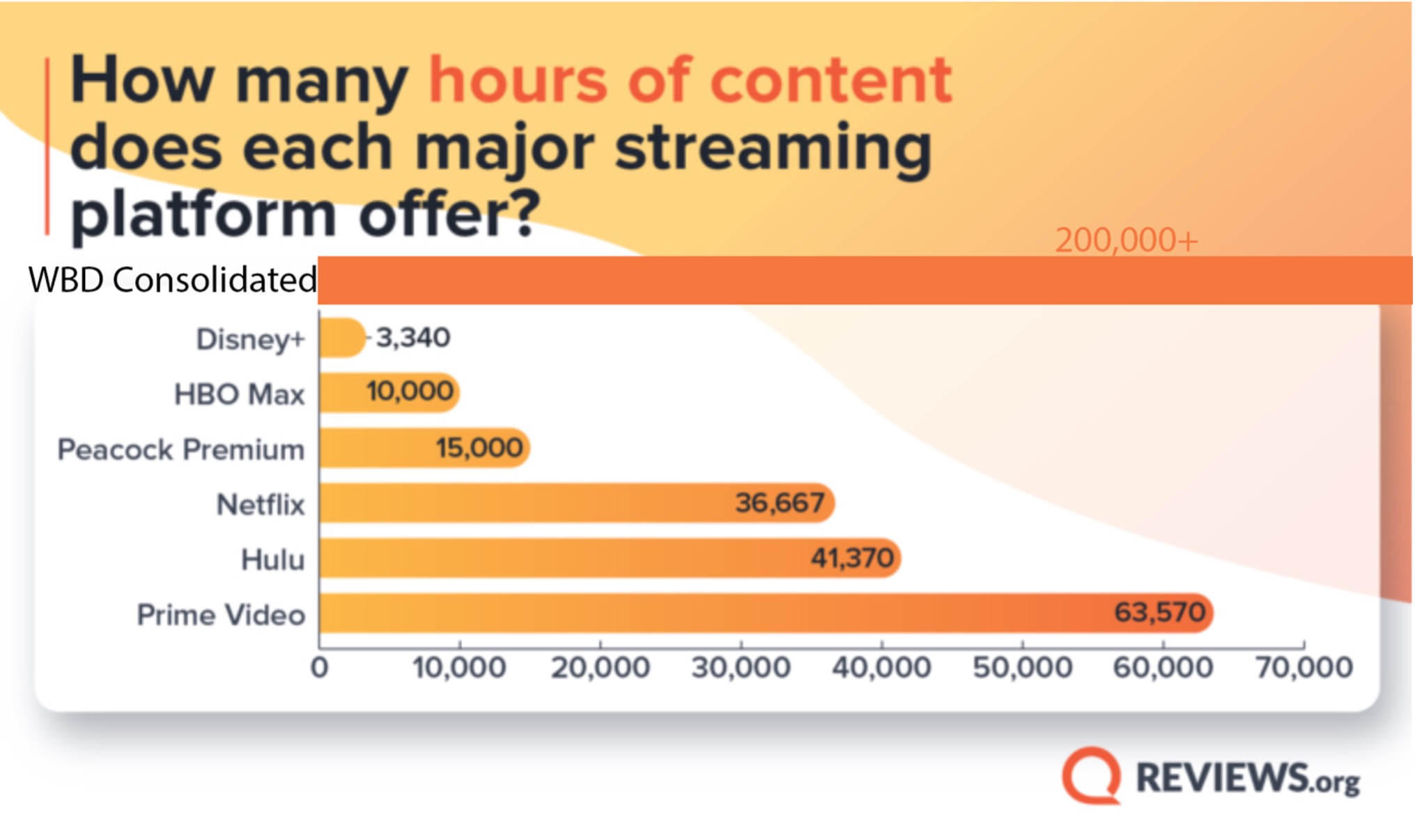

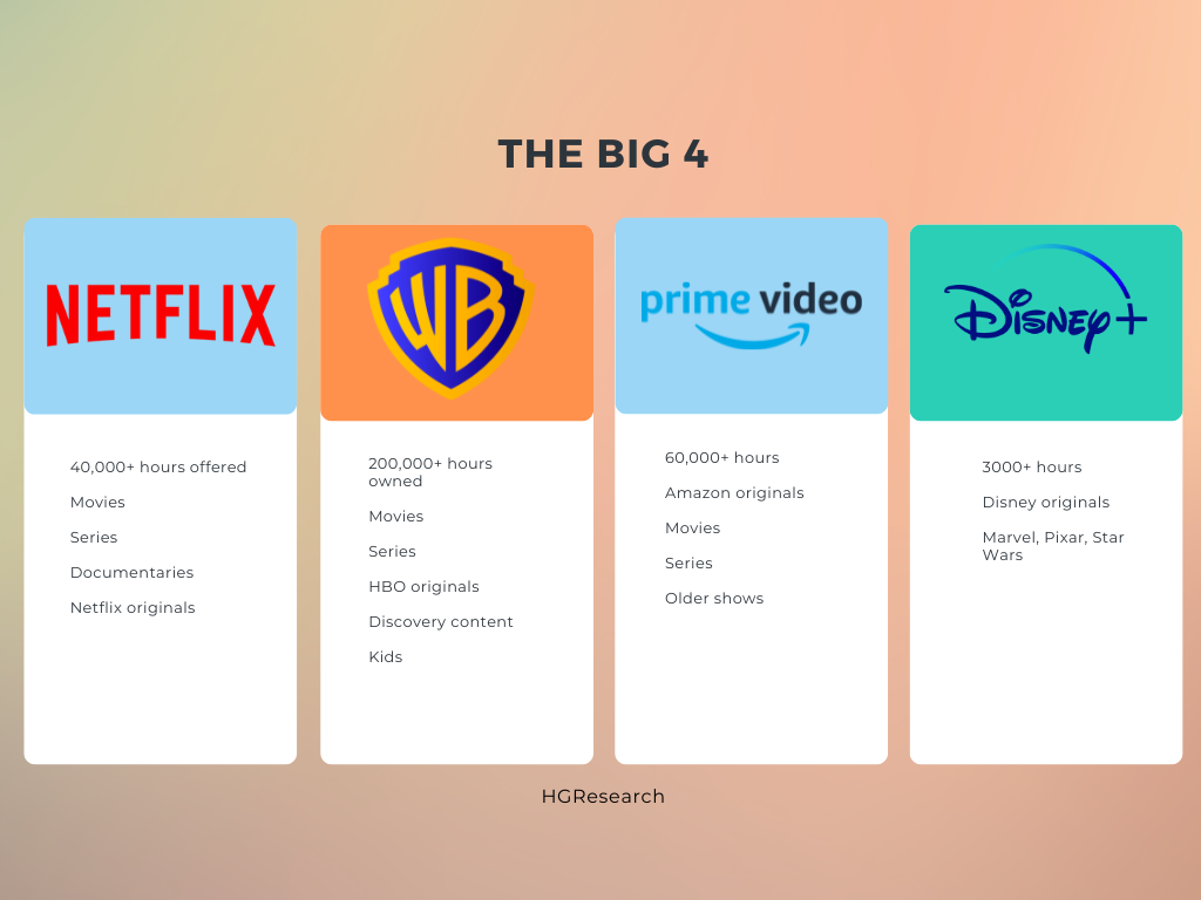

This wonderful infographic below from Reviews.org leads us to the next part of the battlefield we need to understand. The hours displayed are not completely accurate, but they are in the right ballpark. Who are the current players? Netflix, Prime Video, Disney, and HBO Max are the obvious top competitors. How do they compare to each other and what do they offer the consumer?

Before we ignore this sentence to look at the pretty picture below, we need to understand something: below are the hours of streaming content offered not owned by the platform’s owners. Warner Brothers Discovery, which owns HBO Max, actually owns over 200,000 hours (we added these numbers in the image below for effect) of content – did your eyes bulge when you read “200,000 hours”? If not, why not!

It’s not certain whether Warner Brothers Discovery will offer all 200,000 hours of content in its new platform, but more on that later.

Netflix has been aggressive in producing its own content as well as paying for licensing rights from other producers. Amazon recently acquired MGM studios in an effort to bolster its owned content, but that is a small step on a long road compared to how many hours competitors own. Disney only offers a few hours of content, but of very high quality. Warner Brother Discovery leads in quantity.

Quality over quantity? Let’s look at a comparison of the different content the platforms offer.

Warner Brothers Discovery with its larger-than-life library also owns quality, quality brands. Harry Potter, Game of Thrones, DC (Batman and Superman), The Lord of The Rings (licensed out to Amazon). It has a diverse range of content.

We now have a good strategic overview of the battlefield and an understanding of who the dangerous players are as well as what they offer so, it’s time to take a closer look at Warner Brothers Discovery (WBD).

Warner Brothers Discovery

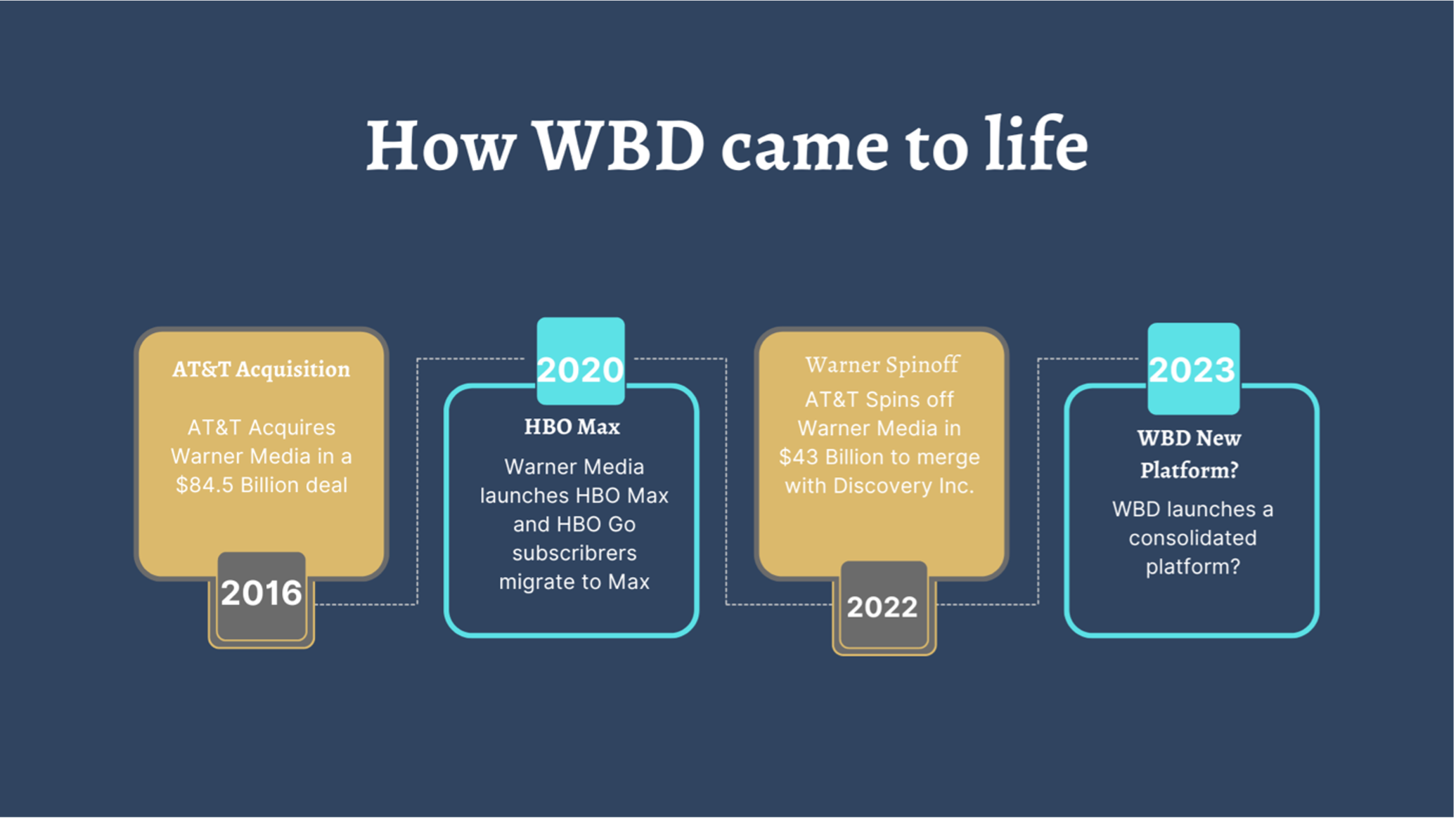

Warner Media and Discovery Inc have merged to create a content behemoth; Warner Brothers Discovery. The new platform with content from Warner Media and Discovery is set to launch in 2023.

The two goliaths combined own an incredible amount of content as seen below.

WBD with 200,000 hours of content. Netflix has 36,000 hours.

Since the end of 2006, David Zaslav has been at the helm of Discovery Inc. He steered the company towards becoming more content-focused but was late in the race to stream the content. Discovery+, Discovery’s own streaming platform, launched in 2021 compared to Netflix’s launch in 2007. Owning all their own intellectual property, Discovery Inc. was making around $3.4 billion in operating cash flow, adjusting for amortization on the cost of their content and using it as a proxy for future content spend, Discovery was making a free cash flow of around $2 billion per year. Before the merger with Warner Media, Discovery traded at around a $14 billion market capitalization, or at a free cash flow yield of close to 15%. If the numbers are confusing, just know this- Discovery Inc was profitable and had a decent cash flow.

David on the left, John on the right.

Discovery Inc. run by David Zaslav was a well-run, profitable company and David Zaslav is a CEO with extensive experience in the media business. Now at 62 years of age, the man is in his business prime and has a close relationship with John Malone. John Malone owned a controlling interest in Discovery Inc. before the merger and he was a media tycoon in his prime and still owns interests and sits on the board of many well-established media companies like Lions Gate Entertainment Corp and Charter Communications. John Malone now owns a substantial amount of Warner Brothers Discovery (WBD) and offers a bridge into future partnerships for the new company.

Now, let’s look at how WarnerMedia, and more specifically HBO, fit into the picture.

WarnerMedia launched its own online service called HBO Go in 2010. The service differed from a conventional streaming platform as we know it because users needed to be subscribed to the cable service to gain access to the online platform. In this regard, WarnerMedia was also late to the streaming game and had a lot less content to offer. HBO Max was only launched in May of 2020 and is still not available in most parts of the world but it already boasts 77 million subscribers.

It should be quite apparent to everyone where this is headed – a single streaming platform with all their respective content combined. David Zaslav spoke to this in the second quarter earnings call of 2021, just after the merger went through. He spoke of offering a single combined platform, with paid, advertising, and ad-lite subscription options that Netflix also just adopted in their most recent earnings call and that led to a 20% bump in their share price. A business model that works well.

So, as an end result, we will have a streaming platform with premium content from Warner Media, laid-back viewing content from Discovery +, and a mixture of other content suitable for all viewers.

The investment perspective

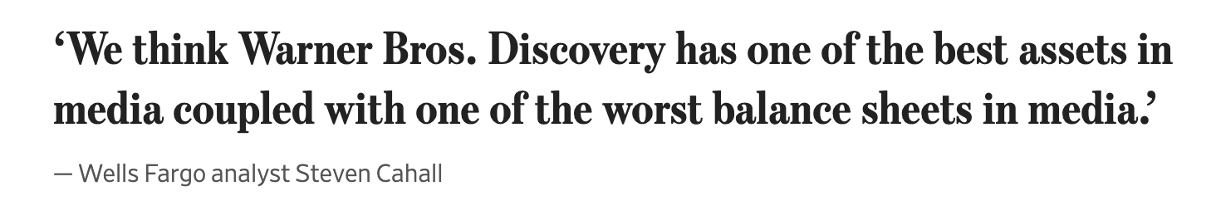

The plan for Warner Brother’s discovery is a simple one; one streaming platform. The road there? Laden with debt, and a messy, restructuring. We are extremely confident that the streaming platform will be a success due to the reasons we spoke of above, so that leaves us with 2 main areas we need to focus on; the debt, and the restructuring.

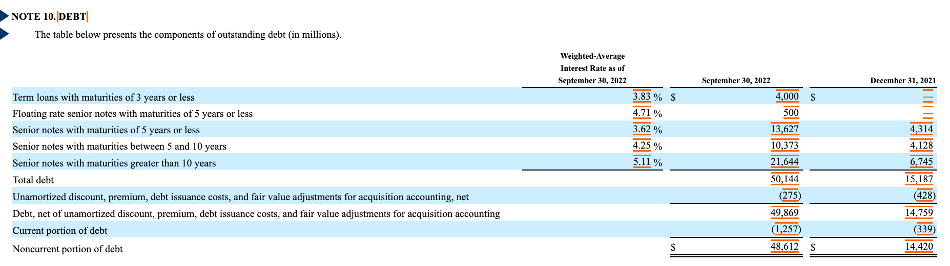

As per its most recent filing, Discovery has $50 billion of fixed-rate debt and a negligible amount of floating-rate debt.

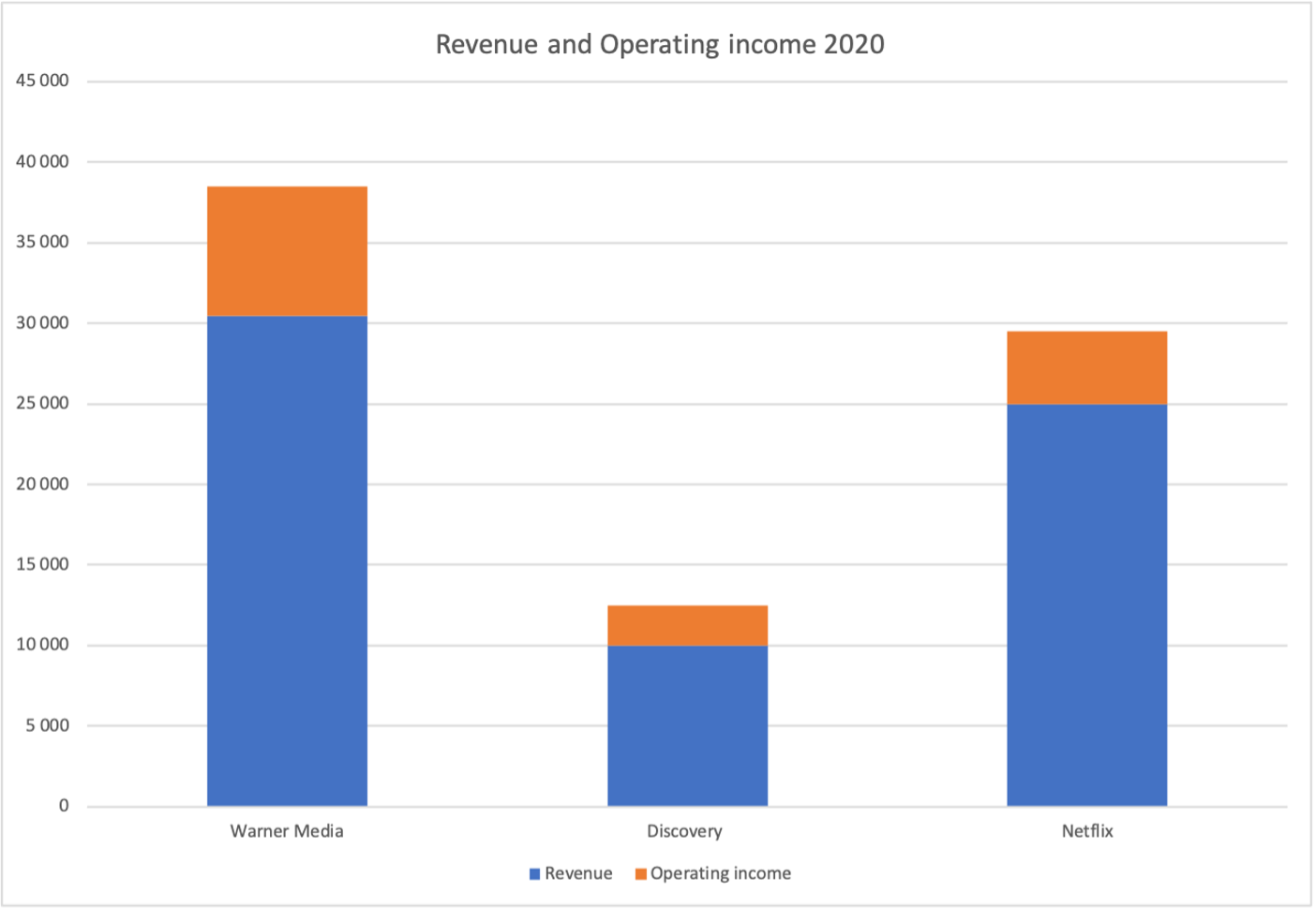

The debt in isolation is meaningless, what matters most is the company’s ability to repay it. We focus on what Warner Media and Discovery Inc. were generating before the merger because we do not have enough financial data post-merger. Below we can see the operating income of the respective companies before they merged. Operating income of above $8 billion combined. This puts Warner Brothers Discovery at a net leverage ratio of 5 times (Net debt divided by the last twelve months of EBITDA). A leverage ratio of 5 is quite high.

Fortunately for investors, David Zaslav is about as ruthless as Edward Lewis from “Pretty Woman”, and has been sawing the fat off of the new company with a chainsaw. He has been canceling new and old productions that were not financially viable in an effort to focus on paying down the debt faster. Here it is straight from the horse’s mouth:

“If a repeat of Two and a Half Men or BIGBANG does three times the reading of a brand-new show that was spending another season that we greenlit of a show that’s costing us seven and a half million dollars. We’re going to cancel that show.” Q3- Earnings Call.

With all hands-on debt, we are quite certain they will be able to reduce the burden via cost cuts, selling content, and increasing revenue generated from the existing HBO Max streaming platform. It will become clearer after at least one year of restructuring.

A last side note on the debt: with increasing interest rates across the world, the market value of Warner Brothers Discovery’s debt has decreased which makes it cheaper for them to pay off the debt.

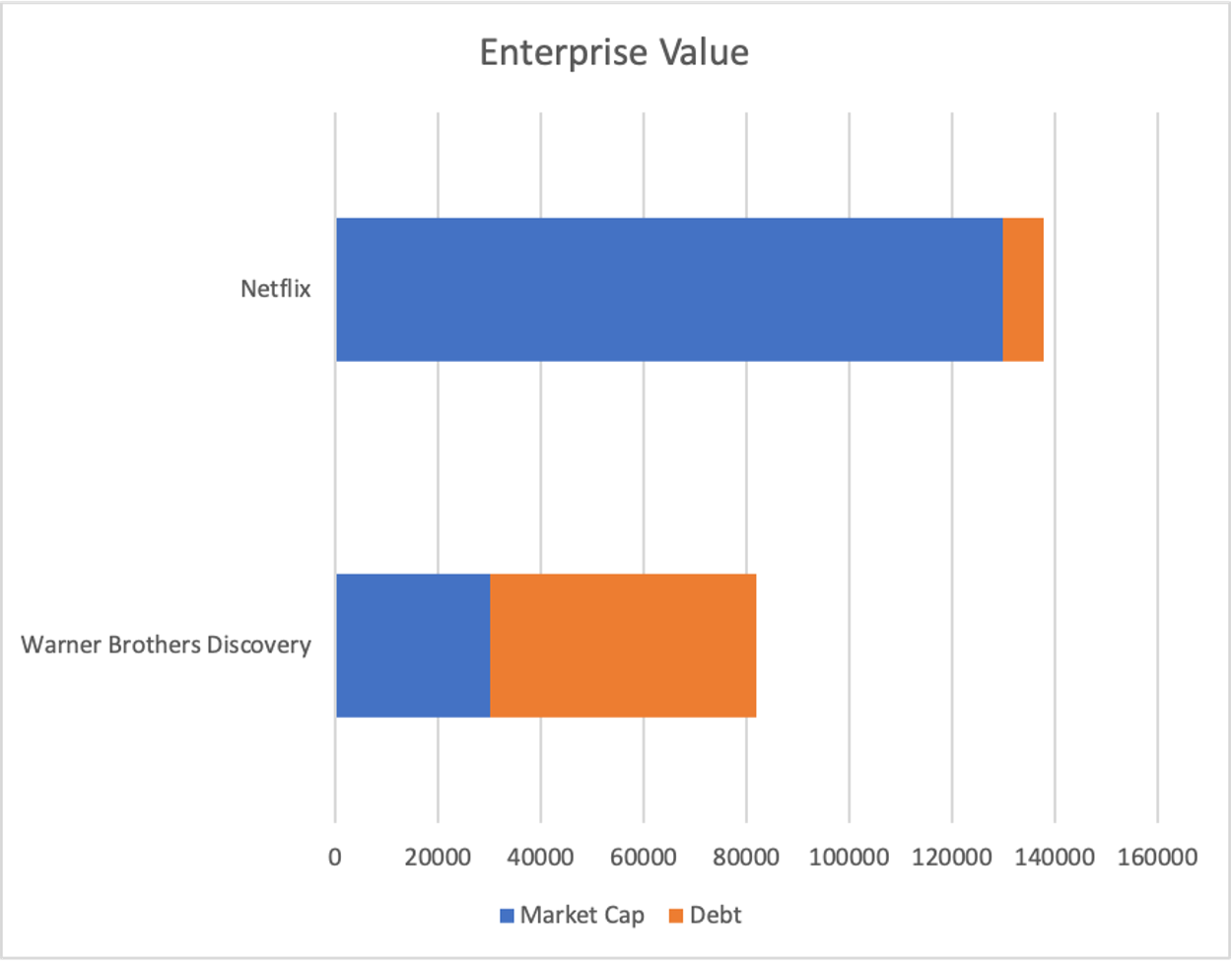

Netflix’s market cap is much larger than Warner Brothers Discovery’s, so much so that we believe Warner Brothers Discovery to be quite undervalued. Due to the large amount of debt WBD has post-merger, a better way to compare it to Netflix is using Enterprise Value. The enterprise value of a company is what you would pay if you wanted to acquire the entire company to take control of its assets – so, you need to pay off its debtors first then buy its assets. Enterprise value is calculated as Market Cap + market value of debt – cash. The difference between the market caps of the company is so large in part due to the difference in their capital structure – Warner Brother’s Discovery has a large amount of debt from the merger, while Netflix’s debt is insignificant.

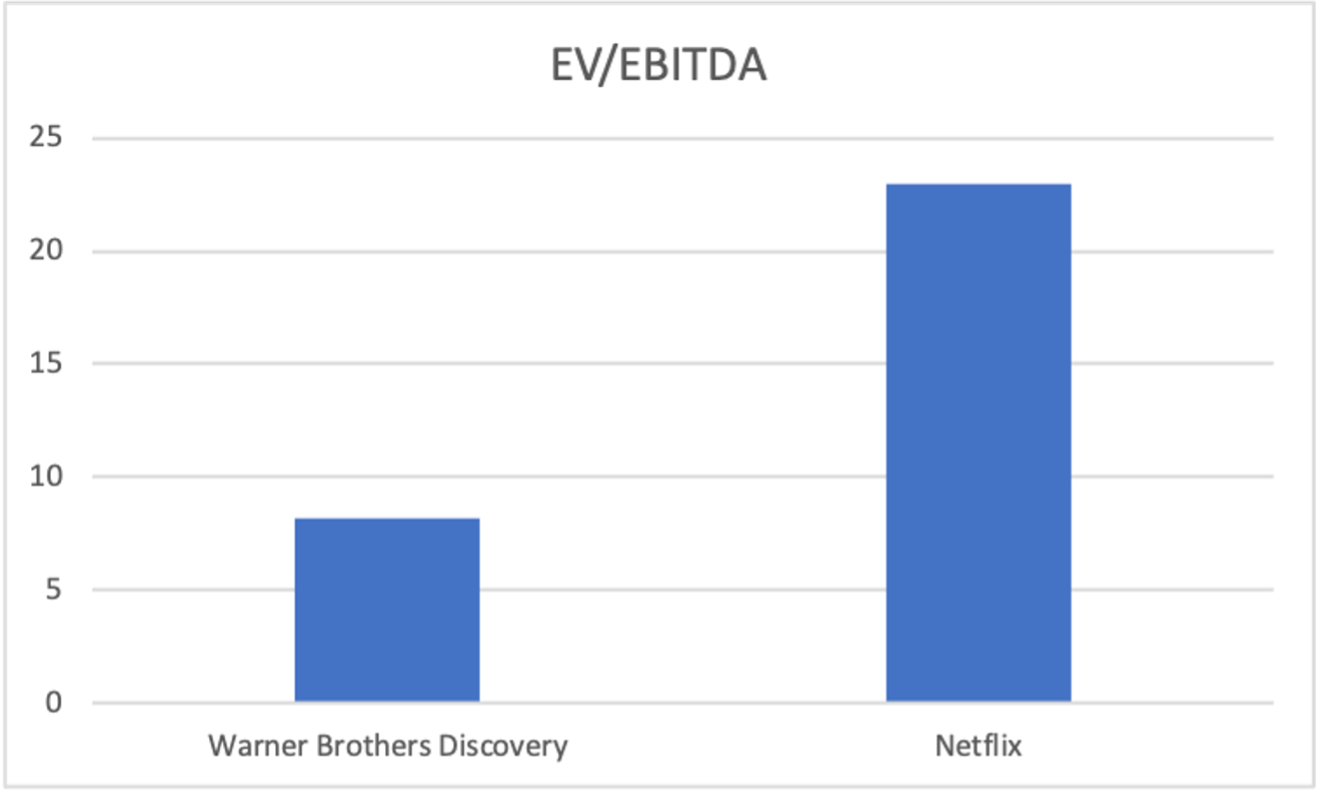

Enterprise value alone tells us nothing. It must be compared to something, and that ‘something’ is operating income or EBITDA. Warner Brothers Discovery (before the messy restricting/merger) has a higher operating income than Netflix but does have a different business model. We must compare the operating income to the Enterprise value. Below we look at Enterprise Value divided by operating income (EBITDA). The lower the multiple, the ‘cheaper’ the company. Think of it like this; an acquirer buys the company for the enterprise value amount and then uses its operating income to pay off the purchase. The lower the number the sooner the acquirer can pay it off.

Comparing market capitalizations of the two companies doesn’t work when one is so loaded with debt, but when we use EV/EBITDA multiple, Warner Brothers Discovery is revealed to be valued much lower relative to its earning power than Netflix.

It seems that the market is very unsure that Warner Bros. Discovery will be successful in paying off its debt and launching a popular new platform leading to it being valued much lower than Netflix.

We are strongly convinced that David Zaslav is the right man for the job, his actions have proven that. The company has a strong cash flow to pay off the debt and the launch of the new platform will create a tailwind for the debt to be paid down faster. After all the uncertainty the market will be forced to reprice the company, and the company will be able to use its vast range of assets to launch exclusive content on its platform. We expect the company to be valued more fairly after this uncertainty has passed, possibly in 3 years or longer.

We will end with a quote from David Zaslav in the most recent earnings call, his voice full of passion:

“As we said last quarter, our focus is on delivering $1 billion of EBITDA in streaming by 2025. And we expect to make significant progress toward this goal next year. Profitability, not purely sub-count is our benchmark for success. While we’ve got lots more work to do, and some difficult decisions still ahead, we have total conviction in the opportunity before us. Warner Bros. Discovery, we’ve got the best assets in the industry, a reach that extends from premium, basic pay-TV and free-to-air to theatrical streaming, consumer products, and gaming, exceptionally talented people across this great company, and the right strategy and financial framework to set us up for long-term success.”

Heiden Grimaud Asset Management initiated exposure to WBD before the Discovery Inc. and Warner Media Merger. At the time of this writing, WBD has a 5% weighting the the Fund’s portfolio.

Heiden Grimaud Asset Management holds shares in Warner Bros. Discovery, however;

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product, or financial instrument, to make any investment, or to participate in any particular trading strategy.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Heiden Grimaud Asset Management.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The authors and HG-Research are not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee, or implication that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.