Reitmans is a family-controlled business (via ownership of a controlling share class) that was founded by Herman and Sarah Reitman. The company was inherited by Stephan F Reitman who is currently the president and CEO.

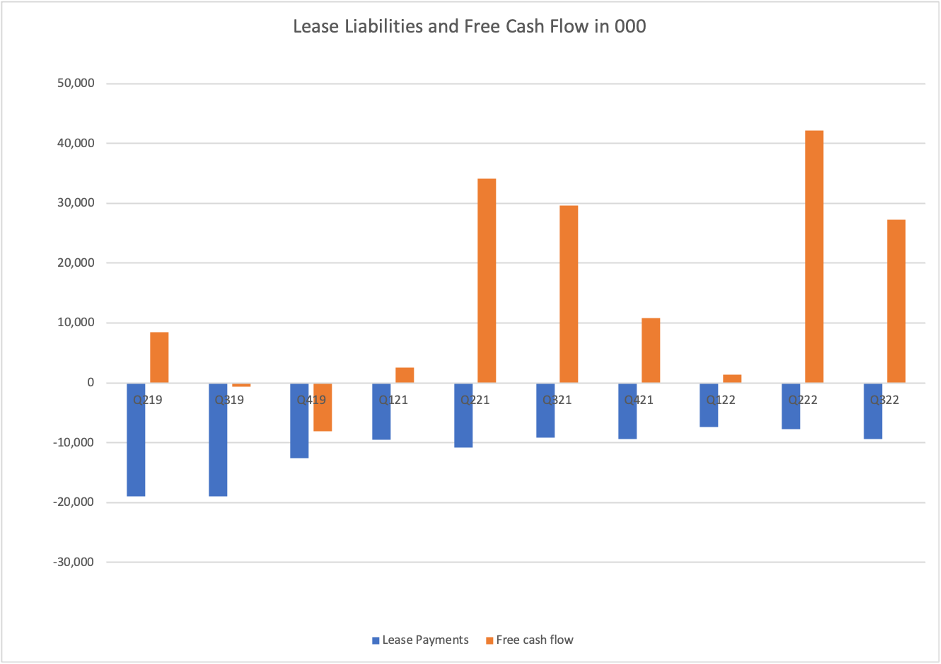

Most retailers were decimated by the pandemic, and Reitmans was no exception- the company entered into CCAA (Companies’ Creditors Arrangement Act), a form of Chapter 11 bankruptcy. However, the company emerged in better shape than ever with very preferential lease agreements and cash flow that almost approximates its market cap.

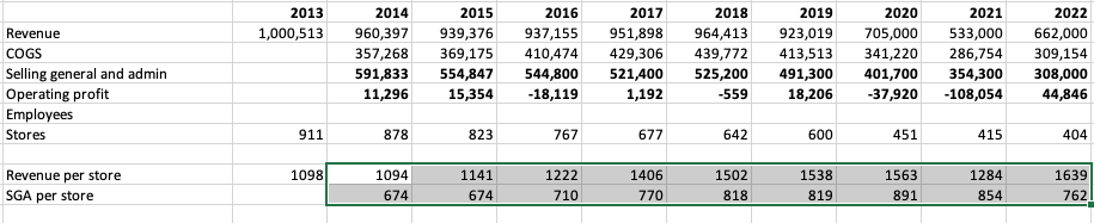

Even before the pandemic retailers were losing market share to online businesses, and again, Reitmans was no exception; for 6 years prior to the pandemic, it only generated an average operating income of $4.5 million CAD.

A significant amount of cash flow was unlocked when consumers moved to e-commerce during the pandemic. Reitmans, for the first time, started disclosing e-commerce sales, which in Q2 of 2022 were at 25% of total sales and moved up to 26% in Q3. E-commerce is a much higher-margin business and it seems that these excess cash flows are sustainable. According to my calculations, 80% of the new excess cash flow is coming from Reitmans’ e-commerce business, with 20% coming from the preferential lease agreements. Cash is building up on the balance sheet, and with no debt and no reinvestment happening in the company, shareholders have a high chance of getting paid out.

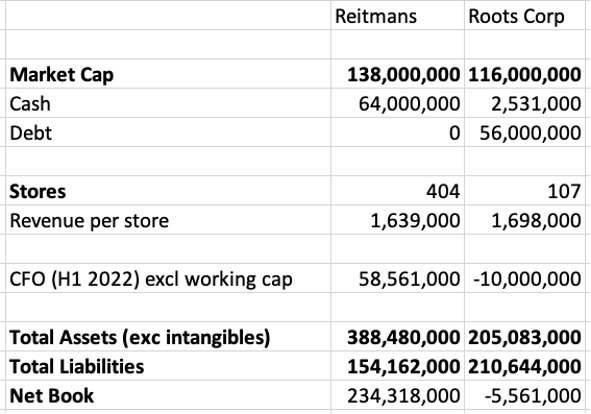

Before we look into Reitmans let’s compare it quickly with a competitor: Roots Corp. Although not a perfect comparison the discrepancy in value between Roots Corp and Reitmans is more than significant. Roots Corp sells Apparel, leather goods, and some furnishings. It has 1/4th as many stores as Reitmans, a similar revenue per store, but a market cap that is almost the same as Reitmans?

It is worth noting too, that Reitmans is currently trading at half of its book value. The discrepancy in value here is large enough to drop jaws. This image itself screams buy, including or excluding the comparison to Roots Corp.

In 2022, for the 39 weeks that ended October 29, 2022- Reitmans had a free cash flow (excluding changes in working capital) of $84 million, or 60% of its current market capitalization. One needs to wonder- prior to COVID this company was doing $4.5 million on average in operating income. How now do we get $84 million in 9 months?

E-Commerce

The shift to E-Commerce during COVID played a significant role. Management disclosing e-commerce sales as a % of revenue for the first time is a clear sign of this. Revenue per store increased from $1.2 million to $1.6 million when you include sales from e-commerce. My calculations indicate that revenue per store has not actually increased and that the excess revenue is coming straight from e-commerce. Selling, general, and admin expenses per store have remained the same. So the value has been unlocked here.

I calculate that their e-commerce business has an operating margin of close to 30% while their retail stores are more like breakeven. In Q2 of 2022 management disclosed, for the first time, that 25% of total sales were coming through e-commerce. Q3 of 2022 (or 2023 financial year reporting) shows that total sales from e-commerce moved to 26%. The shift to e-commerce created by COVID seems sustainable.

I sent the CFO a query regarding the lease agreements and was told that I was not missing anything. Which is short for “we didn’t disclose the information you actually wanted”. The information I want is: how long will these preferential lease payments last? The financial statements and the management discussions say nothing regarding how long these preferential agreements will be in place, only that they benefited the quarter’s results.

Risks?

1- The share classes keep the Reitmans in control of what happens to the free cash flow. Will they be kind to shareholders?

2- The most predicted recession ever is looming.

3- Retailers have been struggling for years.

4- How long do these preferential lease payments last?

On recommendation of HG-Research, Heiden Grimaud Asset Management has not yet taken a position in Reitmans and may or may not do so at anytime in the future, however;

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product, or financial instrument, to make any investment, or to participate in any particular trading strategy.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Heiden Grimaud Asset Management.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The authors and HG-Research are not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee, or implication that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here