There are many ways to think about investing, whether it be a stock, bond, or some derivative. However, the decision to buy or not consists of two factors. The potential return (which is largely subjective) and the probability of the outcome (which is also largely subjective). I say these factors are subjective because, for example, you may find an excellent company with a market-dominating product, but that is not to say it will continue to perpetuate its dominance into the future. Your data can only take you so far in quantifying risks and rewards and after that it is your ability as an investor to weigh that data properly and come to a decision on whether to act, or not. This ability is curated after many years of looking at different companies, and how they performed.

More research helps make these two factors less subjective, but everything cannot be known which is why investors rely on concepts like margin-of-safety and why investors need to diversify.

The Great investor will try his or her best to understand the main risks and then weigh them against the potential reward. The harder it is to understand the risk, the greater the margin-of-safety (or reward) required.

Jackson Financial is in the business of risk.

Variable Annuities

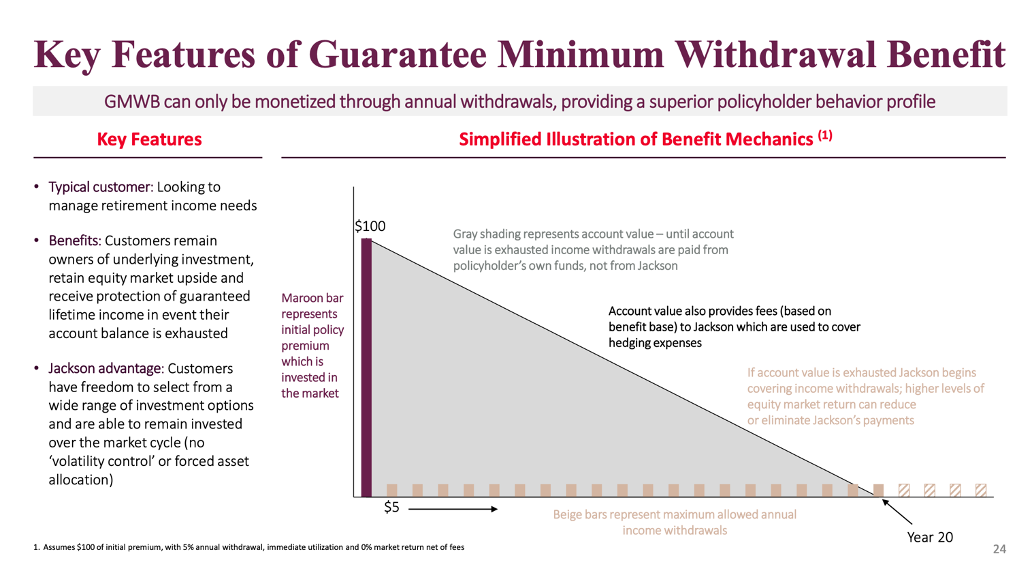

The variable annuity business comes with a lot of jargon. So I will keep this simple. A client buying a variable annuity will put down a lump sum with Jackson Financial. This lump sum is invested into funds of the clients choosing (Jackson offers the widest flexibility in its industry), and at some specified time in the future, the client can begin withdrawing from it. When the client starts withdrawing, they do so at a fixed percentage (let’s call it 5%) of the value of the account at the time of withdrawal. Jackson guarantees this 5% until they die. Jackson makes most of its money on the fees charged on the account value which can rise with the market, and the fee is based on the account value so as the market rises so do the fees.

Jackson does not compete on price, they compete on having a wide and flexible range of offerings.

Below is an example of what the cash flows look like for an annuity assuming 0% market returns. Jackson will make fixed fees on the value presented in the maroon bar below, as well as income on their investment portfolio. Their risks here, amongst others, are that actuarial assumptions regarding mortality rates are wrong. As the market rises, Jackson is able to pay out over a longer period of time (the coverage can extend past year 20). “Higher levels of equity market return can reduce or eliminate Jackson’s payments.”

History & Industry

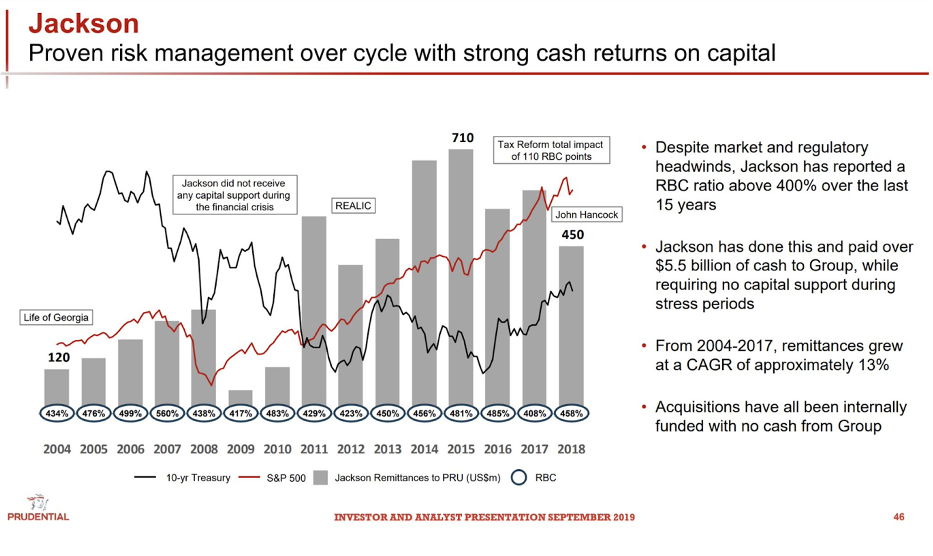

Jackson Financial is the largest seller of variable annuities in the United States, recently spun off from Prudential Financial. Yet the company is valued lower than all its competitors on almost every multiple, a phenomenon quite common amongst spinoffs. It survived the global financial crisis in 2008 without any assistance from Prudential (its Parent at the time), or the government and even gave cash back to Prudential the year after.

The market is struggling to understand Jackson. The future of its business distribution in variable annuities looks bleak and how the company hedges its variable annuities is confusing because Jackson Financial says they use futures, options, and other derivative contracts custom-designed with big banks like JP Morgan Chase. When you delve into the world of derivatives, especially on such a large scale things can get very messy. In order to fully understand Jackson Financials’ hedging strategy you would need to work in the company and be involved in the modelling of their book, and the structuring of their derivative contracts.

Distribution (sales channels)

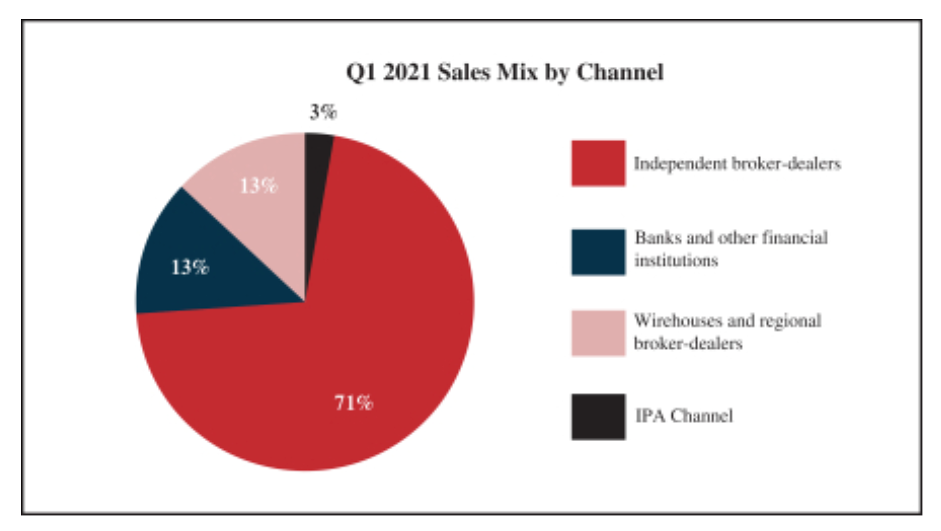

Jackson’s biggest distribution channel is through independent broker-dealers (IBD), but IBDs are becoming smaller and more concentrated in number and the end client has moved more towards doing business with registered investment advisors. Registered investment advisors will move their clients toward ETFs because of their extremely low fees, think of your vanguard S&P ETF – it boasts an expense ratio of 0.03% or 30 basis points. When advisors look at Jacksons’ annuities they see much higher expense ratios on the underlying funds – Jackson wants to slap on upwards of 60 basis points on a contract at the minimum (for the asset management). Products they have been creating for RIAs specifically are not selling, and it’s not just Jackson, its industry-wide. The RIAs are a massive growing distribution market, and the variable annuity industry isn’t positioned to get any of it.

According to LIMRA (The life insurance marketing & Research Association) traditional variable annuities have been struggling in recent quarters.

In the third quarter, traditional VA (variable annuity) sales fell 37% to $13.7 billion, the lowest quarterly results since the third quarter of 1995. YTD (year-to-date), traditional VA sales totalled $48.5 billion, down 25% from the same period in 2021. LIMRA projects traditional VA sales to fall more than 20% in 2022 and not recover to 2021 sales levels ($86.6 billion) for more than five years.” -LIMRA.

Hedging

Jackson has the widest range of variable annuity products. Clients can choose from an expansive range of underlying funds when they pick their variable annuity. What this means is that Jackson needs to hedge the underlying funds to protect the guaranteed minimum withdrawal. When you have a book (an investment portfolio) with so many different funds that need to be hedged it can get tricky because not every fund has the same characteristics.

Jackson seems to have a replication strategy whereby they create a synthetic hedge on the underlying instrument using a combination of custom-made options. They have the blessing of being big enough to be able to get the best deals on their hedging, and they state that before they offer a specific fund on their variable annuity they will first make sure it’s economical from a hedging perspective. Remember, Jackson does not lead on price they lead on their product range. Also, if an underlying’s characteristics begin to perform in such a way that they cannot hedge it economically, Jackson reserves the right to remove the underlying. The guarantee will still be there. Also, funds that begin to change to become uneconomical will most likely be the more exotic types- which will have the benefit of being a smaller part of Jacksons’ overall book.

Jackson Valuation

Adjusted earnings

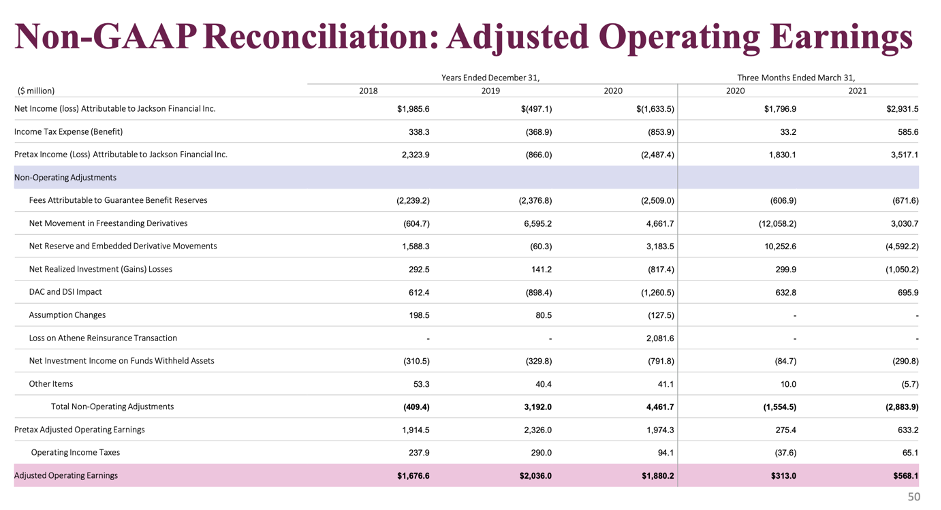

We normally like to tease management who use “adjusted” earnings because they add back all sorts of things to paint a prettier picture of the company, but in Jackson’s case (due to their hedging swings) their adjusted operating earnings is the number we can use to best understand their performance. Their “Adjusted Operating Earnings” which is an after-tax measure has been hanging around $2BN per year for the last 8 years. This is significant on their $3.8Bn market cap.

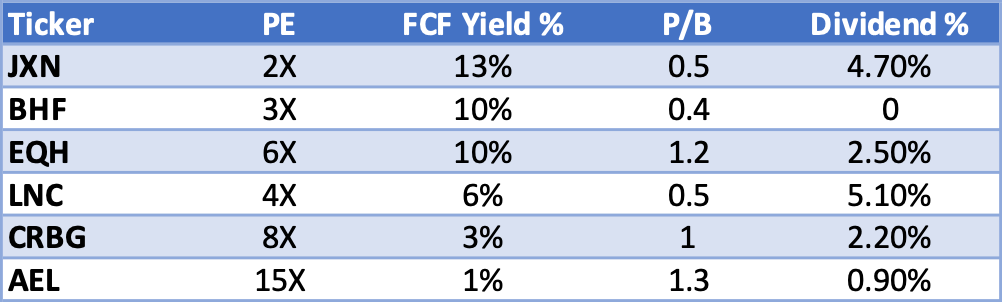

Jackson is the cheapest in its peer group, and your first question is probably- why are all of these companies so cheap?

I believe it’s due to two factors. The variable annuity businesses is losing market share to registered investment advisors who are more sensitive to expense ratios (fees on investments). And, the hedging strategy that Jackson uses is quite hard to understand, so analysts are very unsure of where the risk lies.

We have no argument for or against the variable annuity business losing market share to RIAs. It is just a fact. Jackson has introduced new products, which are growing fast but have a long way to go to get to the point where they diversify Jackson’s revenues significantly.

The other factor- the confusion around the hedging can be thought of a bit differently. It is one thing to understand a strategy, it is another thing to see it stress-tested. For example, would you rather drive a car with safety features you understand or would you rather see the car after the result of a major accident to see how it performed? I would see the car after the accident (or multiple). In Jackson’s case, it survived the global financial crisis without needing any capital from the government or its parent (Prudential) at the time because its hedging strategy worked. The global financial crisis had every combination of risks pushed to the max. And Jackson has also performed well in the many mini-crises we had since then.

The biggest risk Jackson faces from a market-price perspective is if markets go nowhere for 10 years. Because then the fee base doesn’t increase and Jackson will miss all its targets.

Pay-out policy

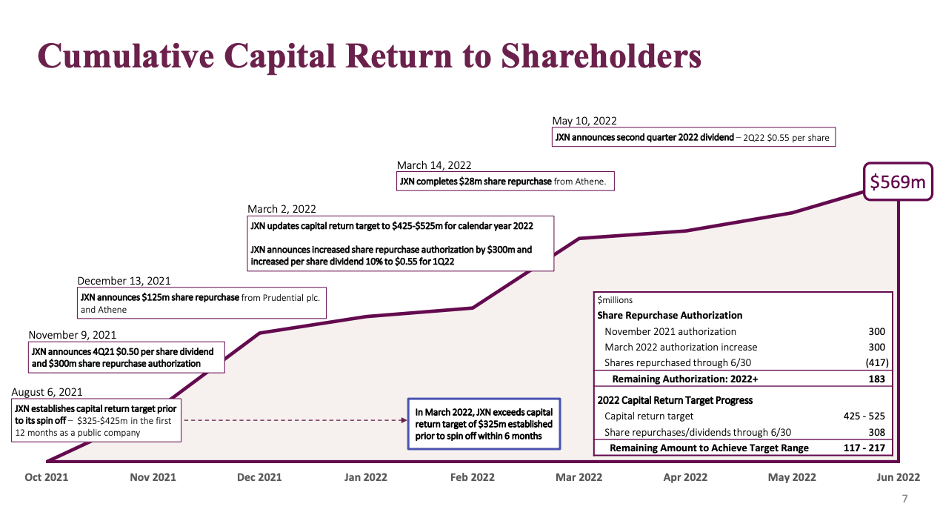

Jackson’s pays out in the form of share buybacks and dividends with a 60-40% split, respectively. They pay out when their RBC (risk-based capital) increases above 400%. It is currently at 500-525% as per their latest presentation.

This is a wonderful pay-out policy, because it means that even if the shares of Jackson do not appreciate, the dividend yield will get bigger and bigger until it forces the market to reprice the shares.

Conclusion

Jackson is a very unique company. It is difficult to understand but has a compelling history. The variable annuity industry is going through changes and Jackson will have to adapt but revenue has not dropped off significantly except in the most recent quarter. Higher interest rates may help their business as people search for a more secure retirement income stream. The company is cheap on every multiple and compared to its peers. Its capital structure also offers a margin of safety from business risk. We are comfortable enough with the hedging risk due to the fact that the company has survived many adverse business conditions without requiring additional funding.

And finally, we believe the company is undervalued.