Heritage Insurance holdings has a potential 450% upside.

Insurers use probabilities to price insurance policies. Investors use probabilities to value companies. Meteorologists use probabilities to try and forecast the weather. In an unlikely event such as this one, we meet with probabilities from all 3 of those areas, insurance, investing, and meteorology. Heritage Insurance Holdings is a Florida-based insurance company that mainly insurers catastrophic and weather-related losses caused by hurricanes.

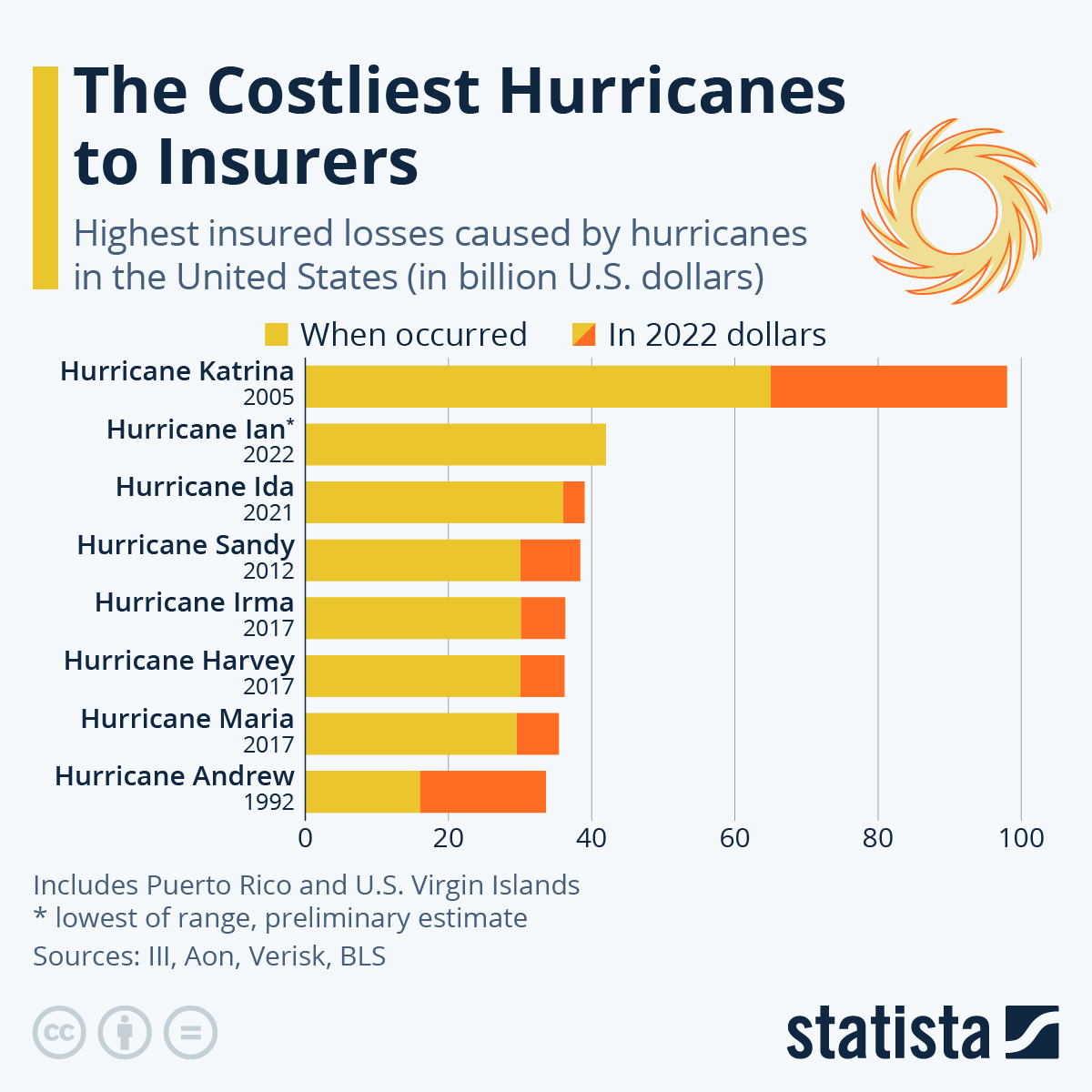

The stock (HRTG) traded at above $10 per share for most of 2020, and only at an average of 7% below its book value until the probabilities started lining up in the wrong way. During 2021 and 2022 the company saw an increase in losses stemming from “weather losses” that were much higher than the years prior. Then, in November 2022, Hurricane Ian made landfall and caused the second-highest insured loss ever recorded after Hurricane Katrina. And to put the cherry on top, the stock was punted from multiple Russel indices which added renewed selling pressure.

Now trading at around $1.4 per share and with an adjusted book value of $6.65, it is hard not to think of the company as a small nugget of gold, hidden amongst the rubble left from a major Hurricane. However, it seems that we are not the only investors greedily eyeing the company- in May 2022, Raymond T. Hyer bought up more than 6% of the outstanding shares at above $3 per share. He recently dipped in again, increasing his holdings at a price of $1.3 and $1.4 per share, and now owns 12% of the company. We are unsure of his connection to Heritage Insurance Holdings and its management but we do know that his company- Futura circuits, is only a quick 20-minute drive away from Heritage Insurance’s office. He probably knows someone who knows something.

The distance from Futura Circuits Corp (owned by Raymond) to Heritage Insurance in Florida.

The founding of Heritage Insurance Holdings

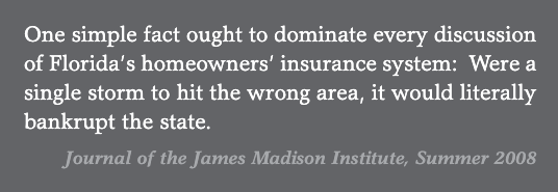

On March 14, 2010, the Florida Council of 100 published a paper titled “Into the Storm: Framing Florida’s Looming Property Insurance Crisis”. The quote below, which is found on the second page of the paper neatly summed up Florida’s property insurance problem.

The state-run non-profit Citizens Property Insurance Corporation (CPIC) became Florida’s biggest residential property insurer. But they were charging “rates that are not actuarially sound”, leading to a massive potential shortfall that they, or their reinsurers, were unable to cover should Florida be hit by a major hurricane.

To address this issue, in 2009, the Legislature started passing measures to come to a more economical solution. Two important changes were made; Citizens started offloading policies into the private sector so that well-capitalized private insurance companies were able to assume the risk. And, private insurance companies were allowed to charge higher rates than previously allowed by regulation. Heritage Insurance Holdings was one of the companies that benefitted from the new legislation.

In 2012 Heritage Insurance Holdings was founded, and offered a $52 million incentive to assume policies from Citizens. The incentive was criticized by state leaders because in 2013 Heritage made a $110,000 donation to the re-election campaign of Governor Scott. Alex Sink, who chairs the board of Florida Next Foundation, claimed that the deal was too good to be fair and allowed Heritage to “cherry-pick” policies from Citizens while not assuming the full risk of the policies.

Since its founding, Heritage Insurance Holdings was doing well and generating a handsome profit off of these cherry-picked policies from Citizens. They survived Hurricane Irma in 2017 by increasing their retention before the storm, and have recently survived Hurricane Ian, and Nicole which made landfall in November.

The company started diversifying into different states to better its risk profile, but it still makes the majority of its income from those Citizen’s offloaded policies. What does it look like as an investment?

An investment perspective

Heritage insurance holdings (HRTG) would be termed an “asymmetric bet” in the investment industry because its upside is far greater than its downside. The cost to play this bet is the current share price of $1.40. The maximum loss is likewise, $1.40 per share or 100%. But if the stock were to trade at its book value (which it historically has traded at) it puts the upside of the bet at more than 450%.

Put down $1.40 and stand the chance to make around $6.00. But, what are the odds? What are the chances that we will make $6.00? This is what makes investing fun, at its most fundamental level, it is a game of probability.

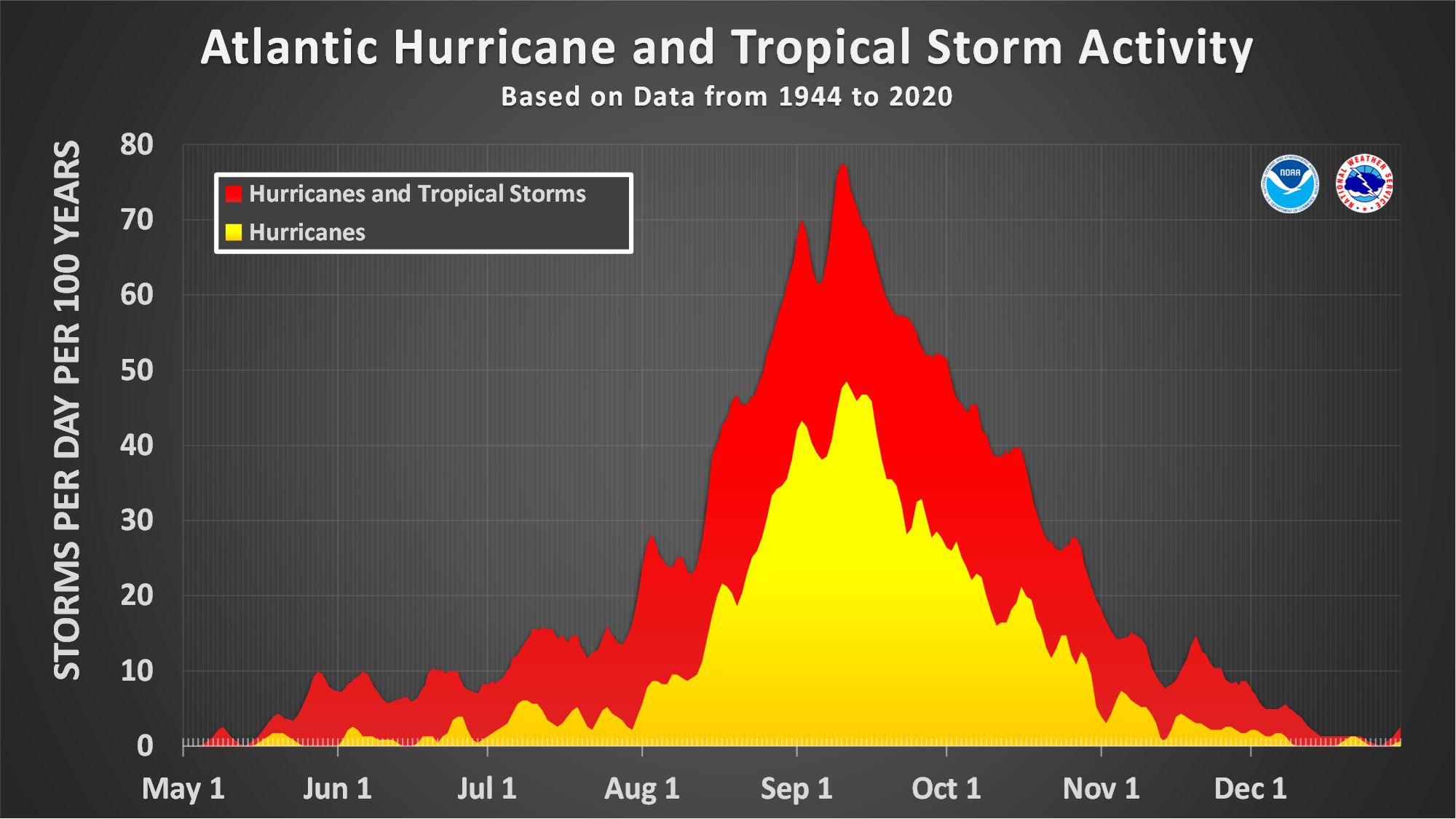

There are a few reasons we think the odds are in Heritage Insurance Holdings’ favor so that the stock will realize the upside, at least in the short term. The first reason is that the Hurricane season is over.

Hurricane season typically starts in August and ends in November. This gives Heritage Insurance some time to raise premiums which they have already started doing, and to earn on those premiums- further increasing book value per share above $6.

The second reason is that management understands how to unlock intrinsic value through share repurchases. The most tax-efficient way to return money to shareholders is through share buybacks and Heritage Insurance has a history of repurchasing shares when the stock traded below its book value. Buybacks made below book value compound the advantages as they are essentially an investment into a company management know better than any other, at very low prices to intrinsic value. Currently, the stock has never traded so far below its book value. The company still has the capacity to repurchase $18.3 million worth of common shares before December 2022 or around 50% of shares outstanding.

The third reason is that management has been investing and moving the business outside of Florida. In 2020, and 2021 the company saw above-average weather losses in Florida. Management has been actively moving risk to different areas.

The risks

What are the odds we realize the $1.4 loss?

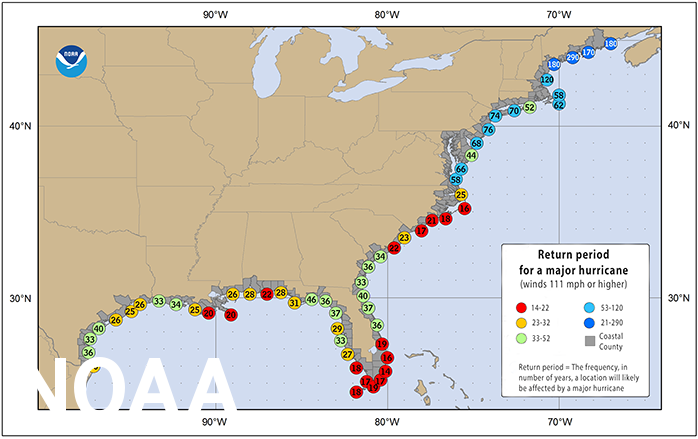

The probability that South Florida will be hit by a major hurricane in a single year is 6.25%. The image below shows the return periods for major hurricanes. A return period of 20 means that during the previous 100 years a major hurricane passed within 50 nautical miles of that location 5 times.

Hurricane Ian made landfall recently on the 24th of September, 2022, and caused an estimated $40 million net retained loss on Heritage’s books. The biggest risk Heritage faces now is that another Hurricane makes landfall, it would most likely wipe out their equity.

The chances that HRTG goes to 0 are higher than 6.25% because even consecutive weather losses in 2023 could cause enough damage to wipe out Heritage, and they would not be categorized as a major hurricane and would not fall into Catastrophic risk, which would reduce reinsurance retention.

However, the odds are still in favor of this not happening. We believe that this investment ultimately carries a great risk-reward ratio. The upside is enormous, and the company is coming out of Hurricane season with raised premiums.

On recommendation of HG-Research, Heiden Grimaud Asset Management recently bought exposure to HRTG on the 20th October and 15th of November at $1.45 and $1.43 per share respectively. At the 15th November, the position made up 5% of the Fund’s portfolio, however;

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product, or financial instrument, to make any investment, or to participate in any particular trading strategy.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Heiden Grimaud Asset Management.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The authors and HG-Research are not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee, or implication that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here