After the Global Financial Crisis in 2008, the financial catastrophe that almost brought the world’s financial system to kneel, it was surprising that only one poor sole in the private sector was held accountable. Wall Street Bankers who were instrumental to the problem, whose ignorance and greed had devastating consequences on the working class, got off with bonuses and bailouts. In the aftermath, it may have at least consoled the common American citizen to see a headline like below which refers to the founder of the Evergrande Group in China.  Unfortunately, the United States government found only one banker guilty – Kareem Serageldin from Credit Suisse, who in the judge’s own words was, “a small piece of an overall evil climate within the bank and within many other banks”. In China’s own housing market crisis, things have played out very differently and executives have been held fiercely accountable.

Unfortunately, the United States government found only one banker guilty – Kareem Serageldin from Credit Suisse, who in the judge’s own words was, “a small piece of an overall evil climate within the bank and within many other banks”. In China’s own housing market crisis, things have played out very differently and executives have been held fiercely accountable.

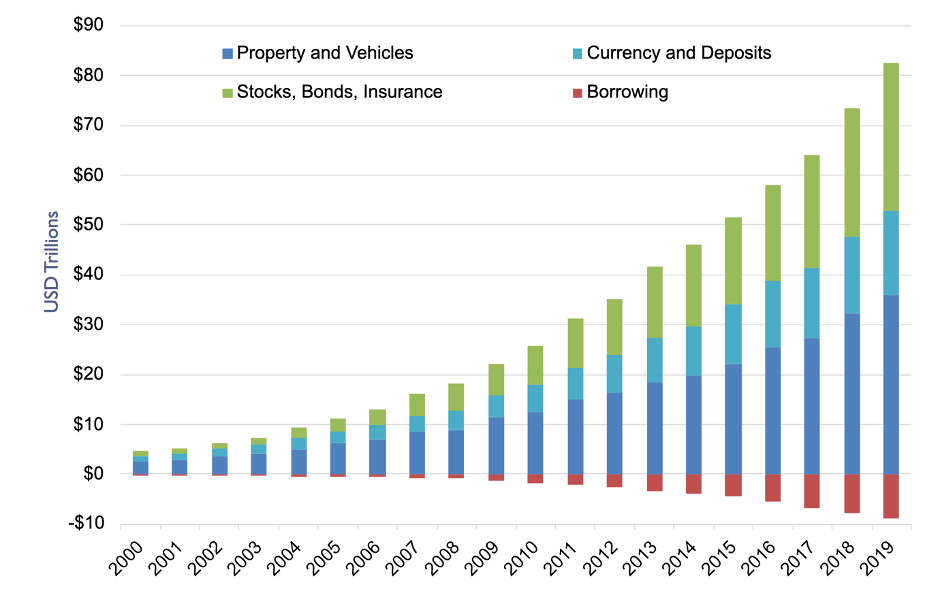

In China, it is extremely important to own a house. It is of cultural importance, and it is important to status. During China’s economic reform, led by Deng Xiaoping, Chinese citizens amassed a large amount of wealth. A large portion of this wealth was invested in property. Demand for property in China was torrential. Growing household balance sheets and a growing population meant that property developers couldn’t keep up. Housing prices rose at break-neck speeds only to take a slight breather in 2008 before continuing. Those who did not own a house wanted one, and those who did wanted another one, the demand was so strong that the government restricted households from owning more than a certain number of houses which even led to couples divorcing to bypass the law, and to buy another property. “Investing” to the average Chinese citizen, means buying a house.

As speculation, real estate in China ticked all the boxes. To quench the thirst for housing, Chinese property development groups like Evergrande bought land from local governments, built high-rises, sold them off to investors, and plowed the money back into more land. It worked well until it didn’t.

China’s population decline and misallocation of capital led to ghost cities and a real-estate bust that has taken out almost every big housing developer in China. Evergrande’s CEO has been forced to sell his private properties to plug the massive gap, but it’s a drop in the ocean. Citizens in some places are refusing to pay their mortgages on unfinished houses and the government has stepped in to try and gain a handle on the reins.

It was inevitable that the housing bubble would burst, and some very bright minds were even quick to put a timer on it, but what happens next? Times have changed, houses are oversupplied, and a more educated workforce is about to inherit wealth from a generation who benefited from the great economic reform. Where will the money flow? Possibly to a Chinese stock market that is now at record lows, levels not seen since 2008, or 1999? Probably.

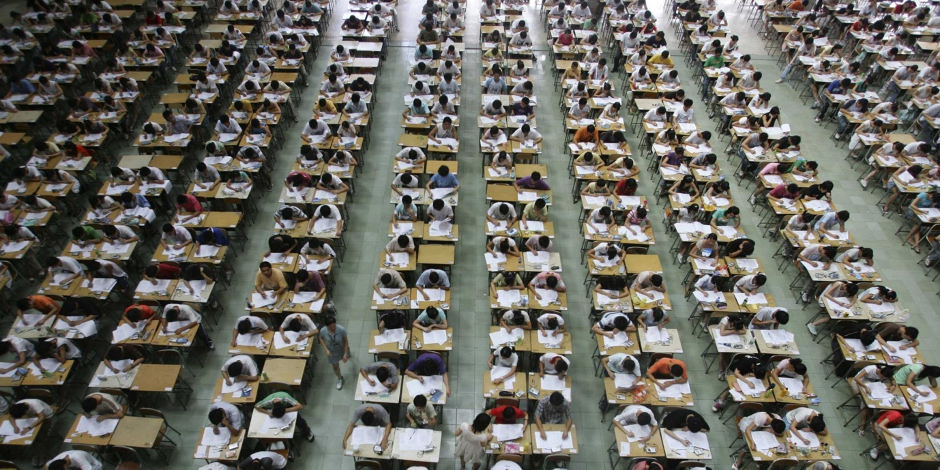

The stock market does not give the Chinese enough credit. In China, Children begin learning English at afterschool classes from as young as 5 years old. Before the government intervened in 2021, children would finish school only to head to after-school classes without a break in-between. The government all but banned after-school classes in 2021 citing that children should not be under such pressure. The pressure stems from the nationwide university entrance exam; the gāokǎo (高考), directly translated to mean “higher exam”.

The results of the exam will, to a large extent, determine what you are allowed to pursue in tertiary education and creates a huge amount of competition amongst school children and their parents who will spend abnormal amounts of money to ensure their child gets the best odds.

Cue: Pink Floyd – Welcome to The Machine

What did you dream?

It’s alright we told you what to dream.

Welcome my son.

Welcome to the machine.

The competition does not cease after the GaoKao, the job market is equally as fierce. Young workers must stand out amongst their peers as they fight for top jobs at renowned companies. This fierce competition birthed the term Jiǔ Jiu Liù (九九六) meaning to work from 9am to 9pm, 6 days a week. The Chinese culture, its dense population, and its economy have spawned a system of ultimate efficiency. What capitalist in China wouldn’t want such devoted labor? Yet the stock market is currently priced as if China’s economy will never get over its long-covid! It is impossible to deny that China ticks the boxes in so many categories from a macroeconomic perspective.

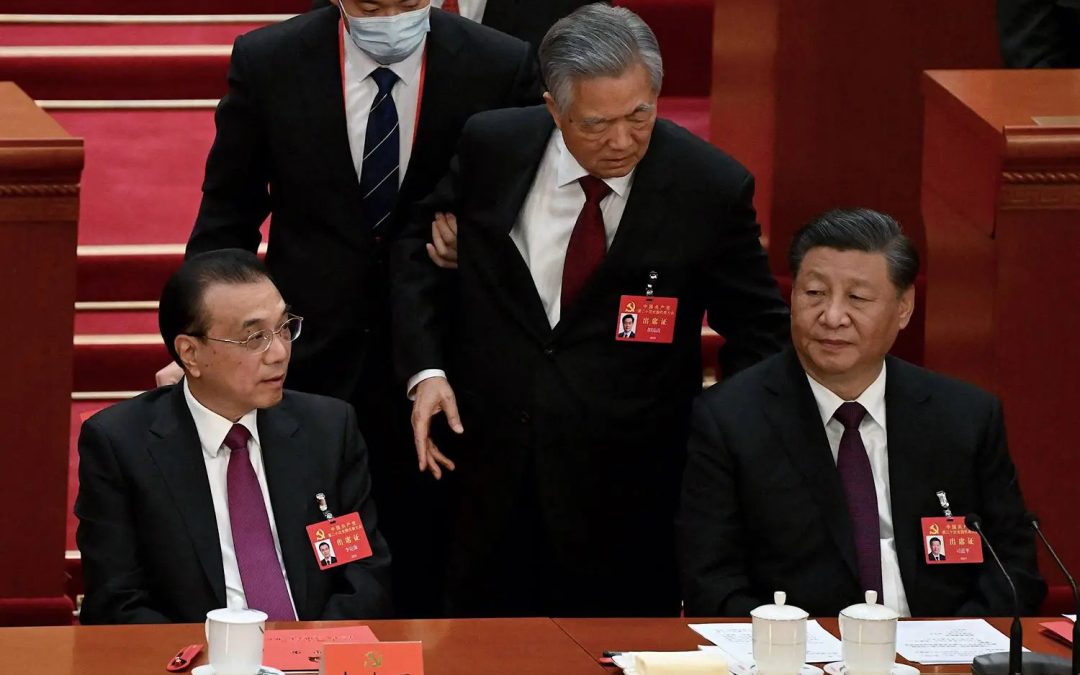

Where is the fear coming from? Why is China’s stock index trading at such a low?

We could spend an entire page writing reasons to fear and then our imaginations could come up with some more.

The truth of the matter is that China’s economy is in a much stronger position than it was many years ago. Since Deng Xiaoping, China has become the manufacturing hub of the world. Supply chains sprawled out like veins around manufacturers are not so easy to move. Aside from the politics, businesses still know that China is the cheaper and more reliable manufacturing option. It has taken many years for China to develop the infrastructure it needed to cater to the world’s consumption demands, and it will take many years more for that to happen in competing countries.

China’s woes are mostly priced in but the upside is not and there are many levers where growth could come from. Just an opening of their economy will create significant momentum in the future. As the economic reform in China took place many Chinese didn’t have the option or the know-how to invest in equities, so most money again flowed into housing. Compared to the rest of the world, and due to mostly cultural reasons, the Chinese invest most of their savings into property. Post-real-estate market collapse it has been seen that more households are investing in equity markets.

After many years of rapid population growth, China’s population is now in decline. New policies to incentivize births are having little effect. An oversupply of housing and a change in sentiment will lead the Chinese to look for other ways to invest.

The opportunity

The Hang Seng now trades around the same level it did during the global financial crisis in 2008, the 2000 dot-com era, or even during 1997 when China’s GDP was almost half what it is now.

The Hang Seng index, which has constituents like Tencent (7%), Alibaba (7%), MeiTuan (7%), some Chinese banks, telecoms, energy, and others now trades at a P/E (price to earnings) of 8. Since its inception, the Hang Seng has traded at an average price-to-earnings multiple of 14. The price to earnings is half of what it historically has been. If you are investing for the long-term, this is the kind of opportunity you have to take. The reward far outweighs the risk at these levels. The risks that were previously hiding in the shadows are now in the middle of the government’s spotlight. The sentiment is at an all-time low and investable funds will need a new place to go. China’s relations with the U.S, although on shaky ground, seem to be improving as their interests warrant mostly mutual cooperation.

On recommendation of HG-Research the Heiden Grimaud Group on the 27th of October, the 1st of November, and the 23rd of November Heiden Grimaud Asset Management initiated and increased exposure to the MCHI ETF, and KWEB ETF. At the last purchase, the positions accounted for 10% and 5% of the Funds portfolio respectively.

Heiden Grimaud Asset Management recently bought exposure to two different ETFs that track the Chinese stock market, however;

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product, or financial instrument, to make any investment, or to participate in any particular trading strategy.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Heiden Grimaud Asset Management.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The authors and HG-Research are not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee, or implication that readers will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.

My sentiment on China in words. Western media are bashing China for “who knows why”. In the long run investors in China will be laughing to the bank.