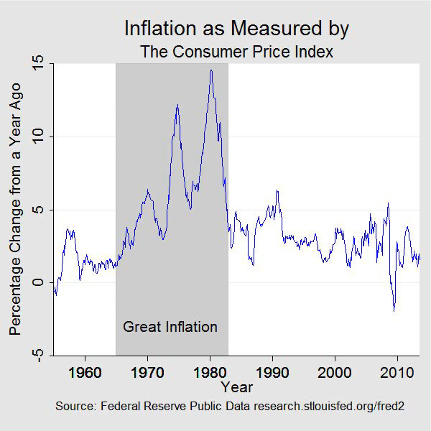

The world seems to be breathing a sigh of relief as the United States’ abnormally high inflation is falling – and fast. But one thing we have begrudgingly learned over the past three years is that nothing is ever that easy. There was a time, forty years ago, when inflation peaked unprecedentedly and fell just as fast. Only to rise again, nearly 3% higher than its first peak.

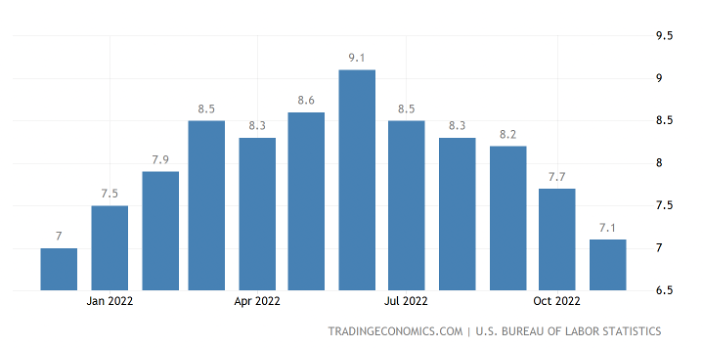

After an unprecedented rise of 6.2% between October 2020 and 2021, the United States reached an inflation level of 9.1% in June 2022. Inflation was the highest it had been since 2008. Thanks to intervention from the Federal Reserve, price shocks abating, and supply chains untangling, the inflation rate is now falling quickly, hitting 6.5% in December 2022.

Are we about to see inflation shoot up again? How did this happen in the 1970s? What looks the same and what looks different? (Besides smoking in offices – different – and ABBA at every party – the same).

How did the Great Inflation happen?

Some of the highest CPI peaks in the history of the United States occurred during the 1970s; a period we now call the ‘Great Inflation’. In 1974, yearly inflation peaked at 11.05%, then declined only to rise again to 13.55% in 1980. The American economy experienced stagflation – high unemployment, low growth and increasing debt while prices continued to skyrocket.

These were the causes of the first peak of 1974:

–Supply shocks in the 1970s. Thanks to the OPEC cartel, the price of oil tripled overnight in 1973. This was at a time when the world was particularly fuel reliant. Along with oil, food prices rose 29% between 1973 and 1974. (Blinder, 1982)

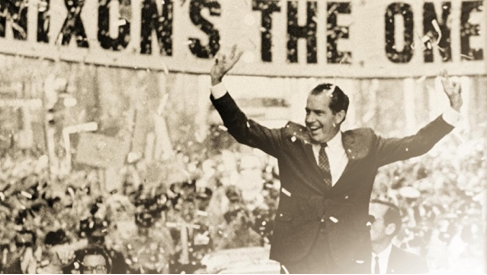

–Disharmony between the central bank and the government. Richard Nixon’s government pursued maximum employment as its foremost economic goal. This was at the cost of what was presumed to be moderately high inflation. The Philips curve, however, is not stable: ever-higher inflation is needed to maintain low unemployment. This left Nixon with both soaring prices and a hit to the job market. (Bryan, 2013)

–Political pressure. Arthur Burns, the widely unpopular chairman of the Federal Reserve at the time, experienced significant political pressure from Nixon to keep interest rates low. And so, Burns kept interest rates low in a climate that was already inflationary. (Abrams, 2006)

Nixon’s politics exacerbated the inflation of the supply shocks. When these shocks were not repeated in later years, however, inflation could decelerate – hence the trough from 1974 to 1977.

Why then, the second peak?

The second peak followed (shockingly?) another round of price disruptions. Between 1977 and 1979 food prices rose by 22%. Political unrest in Iran had the consequence of yet another oil shock. The average cost per barrel of imported oil rose from $15 to $33 between December 1978 and March 1980. A third shock was to mortgage interest rates, which rose from 9% per annum in 1977 to 10% by the end of 1978. (Blinder, 1982)

How did the Federal Reserve bring inflation down?

At first, they didn’t. In his paper, The Anguish of Central Banking (1979), Arthur Burns himself expressed skepticism at the power of central banks to control inflation. Thus, during the 1970s, US prices were largely at the mercy of supply shocks. This is not the case now – today, controlling the price level is what makes for a successful central bank.

There were two attempts to bring down inflation before 1980 (Bryan, 2013):

–Wage and price controls. Set by the Nixon administration between 1971 and 1974, these controls only temporarily slowed price hikes and ultimately worsened shortages.

–Gerald Ford’s ‘Whip Inflation Now’ (WIN). After succeeding Nixon in 1974, Gerald Ford had no better luck with controlling inflation. A compelling name was just about as far as this program went. In short, WIN was a drive to encourage consumers to spend more sparingly.

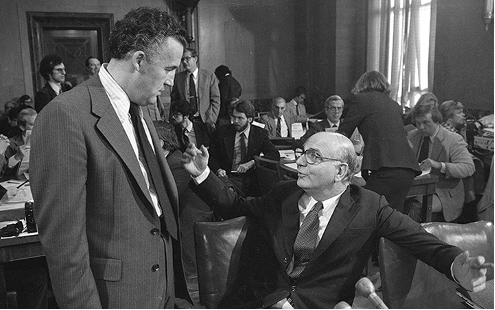

To the Nixon administration, unemployment was a real evil. Inflation? An inconvenience. The public proved less willing to make this trade-off. By the mid-1970s, public confidence hit real lows: inflation was viewed as the primary cause of stagnation. And so, Ford and his successors made tackling inflation the country’s foremost priority. Paul Volcker, who took over as Chairman of the Federal Reserve Board in 1979, would serve this priority.

Volcker acted as follows (Bryan, 2013):

–He made bringing down inflation his primary concern. Volcker reframed bringing inflation down as serving the dual mandate, even if the process would temporarily increase unemployment.

–The reserve growth rate was slowed, and interest rates were increased. Introducing greater control over the money reserve and growth had the successful, albeit slow, effect of bringing down inflation. This was complemented by credit controls and tighter regulation as a result of the 1980 Monetary Control Act.

It took years for Volcker’s policy to produce real results. The US was hit with a recession in early 1980 and another from July 1981 to November 1982. Despite this, Volcker’s interest rates remained persistently high. Eventually, the Fed’s unwavering commitment to reducing inflation gained credibility. What followed was a decline in unemployment and an end to the recession. The Federal Reserve has committed to a stable inflation rate ever since, earning its status as a credible inflation fighter. (Bryan, 2013)

Is history repeating itself?

The accelerated rise in inflation to June 2022 and its similarly speedy drop has many drawing similarities between inflation today and the disaster of the 1970s. Will inflation shoot up again despite this recent decline?

These are the circumstances giving economists déjà vu (Kose, Ohnsorge & Ha, 2022):

–Supply shocks are to blame for modern-day inflation. As was the case in the 1970s, shocks to prices are driving inflation today. Overall price hikes, as a result of disruptions to production during COVID-19, are one contributor. Another is the Russia-Ukraine war and the resultant increase in the fuel price.

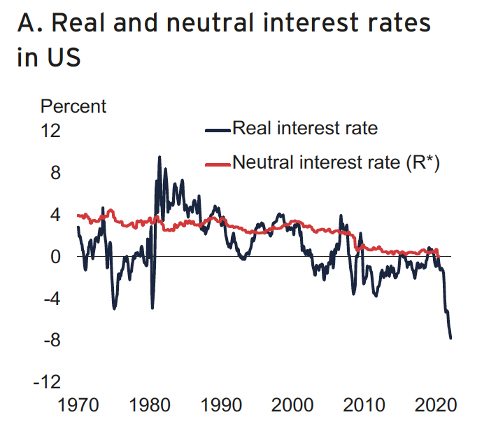

–Monetary policy was extremely accommodative before the shocks. Interest rates were low to stimulate employment. This, too, was the case in the 1970s. The concern here is that it requires policy to be tightened quickly and drastically to combat inflation. This could lead to another recession – as was the case when Volcker acted in 1980.

There are, however, important differences between the way the Federal Reserve acts now and what was possible in the 1970s. For one, even Jerome Powell wouldn’t take out a cigar in front of Congress.

Here is what looks different (Kose, Ohnsorge & Ha, 2022):

–The supply shocks are smaller. In real terms, present oil prices are only around two-thirds of what they were in the 1970s.

-The second peak was a result of a repetition of shocks. With no further pandemic or invasion (fingers crossed), we will not see another dramatic rise in the CPI.

–Monetary policy is not what it was in the 1970s. The Federal Reserve looks very, very different from what it did then. Since the 1980s, it has been credible in its commitment to keeping inflation low: it operates transparently and with justification.

–The Fed learned lessons from the 1970s. Namely: solving the time inconsistency problem. Anchoring inflation at a target of 2%, as was done twenty years ago, fixes consumer expectations to 2%.

The Federal Reserve acted swiftly, in keeping with its reputation, to lower inflation following a dramatic rise in CPI. Without further supply shocks, the world will not see another sudden peak. Even if the worst happens, the lessons learned from the Great Inflation have fundamentally changed the way the Fed operates.

Keeping interest rates high will, as it did in the 1980s, come with short-term recessionary consequences.

What’s next?

With a keen eye on risks to price shocks, which could come from the Ukraine-Russia war or China reopening the outlook for inflation is not as clear cut as the market seems to believe. A combination of price shocks and the easing of financial conditions that we have seen in the Financial Conditions Index could lead to inflation that persists at a higher than 2% level.

As the stock market rallies and financial conditions ease, the risk that inflation troughs or remains at a higher level increases. A trough in inflation would shock the Fed into real action.